Business Ethics & Transparency

Partnerships > Business Ethics & Transparency

Business Ethics & Transparency

Significance & Commitment

Business ethics stands at the heart of stakeholder trust and long-term business success. For Banpu, operating business by adhering to ethical practices is not only for maintaining a strong corporate reputation but also forms the foundation of stakeholder confidence. The Company is committed to upholding the highest standards of corporate governance and ethical conduct.

Management Approach

The Company published a Corporate Governance Policy and Code of Conduct that align with international standards such as the ASEAN Corporate Governance Scorecard, the Organization for Economic Co-operation and Development (OECD), and the CG principles of Thai listed companies according to the Securities and Exchange Act, the Securities and Exchange Commission, and the Stock Exchange of Thailand. The CG Policy and Code of Conduct have regularly been reviewed. The latest revision was announced in 2018. The Company also raises the business ethics awareness through various activities as follows:

Business Ethics Linked to Employee Remuneration

Banpu emphasizes the importance of adherence to the Corporate Governance Policy and Code of Conduct by integrating ethical behavior into the employee compensation framework. Annual compensation is determined based on 2 key factors: performance outcomes and behavior alignment.

The annual performance evaluation is structured with 70% weight on Key Performance Indicators (KPIs), measuring employees’ actual performance against goals, and 30% on behavioral alignment with the corporate culture, “Banpu Heart.” Within this behavioral component, the “Committed” dimension defines behavioral characteristics that reflect business ethics, emphasizing the principle of “Do the right things, always”. This criterion reinforces the expectation that all employees act with integrity, accountability, and professionalism in their roles.

The results of the performance evaluation serve as the basis for determining annual compensation adjustments and as a guide for employee personal development plans, ensuring that both capability building and value-driven culture are sustained across the organization.

Corruption Risk Assessment

Each year, the Company conducts a comprehensive corruption risk assessment across all business units, including subsidiaries and joint ventures. The assessment results are submitted to the Risk Management Committee for oversight and continuous improvement. These assessments are designed to identify potential vulnerabilities and guide the implementation of preventive measures tailored to business-specific contexts. Based on the 2024 assessment, key corruption risks included reputation risk from gifts to key stakeholders and reputation risk from benefits to government officials.

Key Corruption Risks and Mitigation Measures

Reputation risk from gifts to key stakeholders

Reputation risk from benefits to government officials

Description

Accepting and offering of gifts during occasions (i.e., New Year, organizational reshuffles, or retirements) may lead to perceptions of undue influence or favoritism

Provision of improper benefits during permit and license application processes could result in operational delays or legal repercussions

Impact

Bias or jeopardize business opportunities

Operational delays or suspension of business activities

Mitigation action

· Announced stakeholder relations management policy

· Reinforced anti-corruption policy

· Deployed corporate standard for accepting and offering of gifts, hospitality, or other similar forms of reward

· Adherence to the No Gift Policy

· Reinforced anti-bribery and corruption policy and the Code of Conduct,

· Established standard procedures for permit and license management and obligation fulfillment & monitoring

· Rigorous document verification to ensure compliance and avoid unnecessary delays

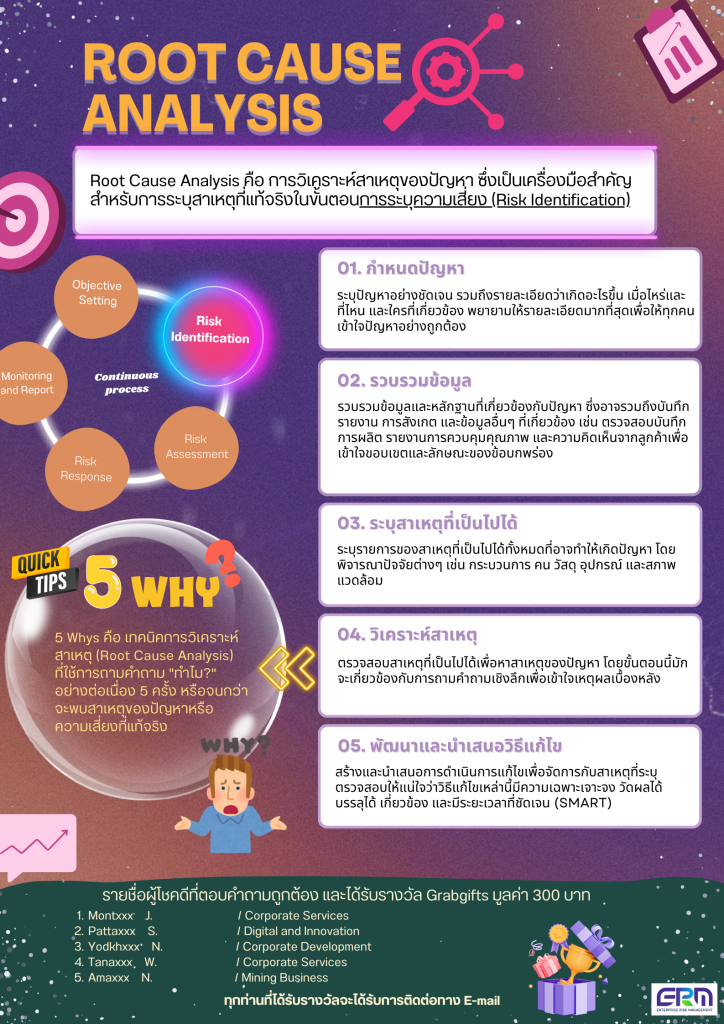

ESG Risk Management Framework

The enterprise risk management (ERM) framework is implemented across the organization. To ensure alignment with the Company’s strategic objectives, stakeholder expectations, and sustainability commitments, ESG factors are fully integrated into the ERM framework, with governance oversight provided by the Board of Directors and the ESG Committee. The process consists of 5 key elements: identification, assessment, mitigation, monitoring & reporting, and risk awareness.

1. Identify Risks: ESG risks are identified across operational, environmental, social, and governance dimensions. This involves stakeholder engagement, expert consultation, and external trend monitoring to anticipate emerging challenges and opportunities.

2. Assess Risks: Risks are evaluated using a risk matrix to analyze and assess both likelihood and impact. The results are visualized through a risk map to prioritize the risks that may have significant impacts and enable targeted risk response planning.

3. Mitigate Risks: Tailored risk management plans are developed for high-priority risks. These include operational improvements, policy updates, and proactive measures to minimize potential impacts and leverage business opportunities.

4. Monitor and Report Risks: Risk profiles are continuously monitored, with regular updates to the Risk Management Committee, Audit Committee, ESG Committee, and the Board of Directors. This ensures that responses remain aligned with governance and organizational priorities.

5. Promote Risk Awareness: Risk awareness is fostered across the organization through training, internal communications, and stakeholder engagement. This encourages proactive risk management and alignment with ESG objectives.

Risk Integration into Product & Service Development

Banpu integrates risk criteria into product and service development by embedding risk assessments into the investment decision-making process. The comprehensive ESG due diligence is conducted to assess environmental and social impacts, regulatory compliance, and mitigation measures for high-risk areas identified in the risk profile. This approach ensures alignment with sustainability principles, financial targets, and regulatory requirements while impact analysis and mitigation plans proactively manage risks and drive long-term value creation.

Risk Culture

The Company promotes a robust risk management culture by incorporating risk considerations into key decision-making forums and embedding risk management practices into employee training programs. Risk workshops are organized to enhance employees’ understanding and strengthen their risk assessment capabilities. In addition, communication materials and engagement activities are developed to encourage active employee participation in risk-related initiatives, fostering greater awareness, ownership, and engagement.

Tax Management

Being a responsible corporate citizen in every country where we operate is the Company’s top priority. In addition to compliance with applicable laws and regulations, the Company demonstrates a strong commitment to transparency through the disclosure of tax payments. Moreover, the transfer price for intra-group service transactions is conducted based on principles of transparency and fairness to ensure the appropriate and equitable benefit to the host countries. For transparency, all tax-related information is disclosed to relevant stakeholders in accordance with international best practices and in alignment with local regulatory requirements.

Year in Review

In 2024, Banpu successfully renewed its membership in the Thai Private Sector Collective Action Against Corruption (CAC) for the third consecutive term, reaffirming its commitment to ethical business practices. The Anti-Corruption Policy was also revised to align with the latest CAC guidelines. Moreover, A series of awareness and communication activities was launched under the theme “CG Whistle Guard.” These activities were organized across the group, with particular focus on the mining business in Indonesia.