Risk Management

Risk Management

Significance & Commitment

The business environment undergoes volatility and uncertainty situations.

Paying close attention to an effective risk management not only prevents any possible adverse impacts on the business but also enhances the business opportunities for the Company.

Management Approach

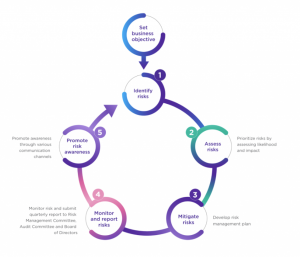

The Company’s group-wide risk management is under the supervision of the Board of Directors through the AuditCommittee. Risk management is integrated into all business processes, from strategic development to operationalactivities. At a corporate level, Risk Management Committee (RMC) chaired by the CEO has been established to monitorthe high priority risks including the mitigation plans and performances at all business units. RMC reports performance tothe Audit Committee and the Board of Directors on a quarterly basis. Risk appetite is reviewed regularly to align with theCompany’s strategy with the latest revision in 2018. Apart from the RMC, there are also other meetings relevant to riskmanagement such as the financial management committee and the commodity risk management committee.

At operational level, each business unit identifies, analyzes, mitigates, and monitors its risks with a requirement to setkey risk indicator and submits a quarterly report to the enterprise risk management team. Environmental, social andgovernance (ESG) principles are also integrated as part of the risk identification and management process. It is alsorequired for all business units with high ESG risks to develop the risk management plans.

To ensure that risk management is integrated into day-to-day operations, the Company developed the mobileapplication “Compliance risk management (C-RiM)” as a real-time compliance data platform and promotes employeeawareness through various communication channels, such as e-newsletter, town hall and other activities.

Year in Review

In the review of long-term ESG risks and risk responses, the Company has rigorously identified certain ESG risks that pose significant challenges to the operation and sustainability goals. Among these, 3 ESG risks have been defined as high priority due to their potential impact on the Company’s performance and reputation: Human capital capability, Cybersecurity & personal data protection, and Climate change. Additionally, 2 emerging risks have been identified: Geopolitical risk and Geoeconomic Confrontations, and Insufficient ready identified talents for business operations and growth

Despite comprehensive mitigation actions developed for all these identified risks, the enterprise risk management framework currently does not fully cover one crucial aspect: Supplier management. This represents approximately 2% of ESG issues not yet fully integrated into the Company’s risk management system.

Acknowledging this gap, the Company is actively working to enhance our supplier management practices. Efforts are underway to establish clear ESG standards for suppliers, alongside defining criteria for selection, auditing, and measuring their ESG sustainability performance to ensure that the operation of all suppliers is fully aligned with ESG principles.